🛕 Why Donate to Shri Jagannath Mandir, Thyagraj Nagar, Delhi?

Donating to Shri Jagannath Mandir is more than a religious offering—it’s an investment in spirituality, culture, and social welfare. As a registered charitable institution eligible under Section 80G of the Indian Income Tax Act, donations made here offer both divine blessings and financial benefits.

🙏 Spiritual Benefits of Donating

-

Fulfillment and Devotion: An offering made at Shri Jagannath Mandir is considered sacred and earns spiritual merit (punya).

-

Inner Peace: Regular donations align with dharma (duty), promote inner peace, and improve karma.

-

Blessings from the Divine: Devotees believe that contributing to temple causes brings divine blessings from Lord Jagannath.

🧘♂️ Personal & Mental Well-Being

-

Sense of Belonging: Donations connect you with the temple community and its noble causes.

-

Mental Peace: Supporting causes you believe in contributes to reduced stress and emotional satisfaction.

-

Family Values: Encourages a culture of giving within your family, rooted in faith and tradition.

🫂 Social & Cultural Impact

-

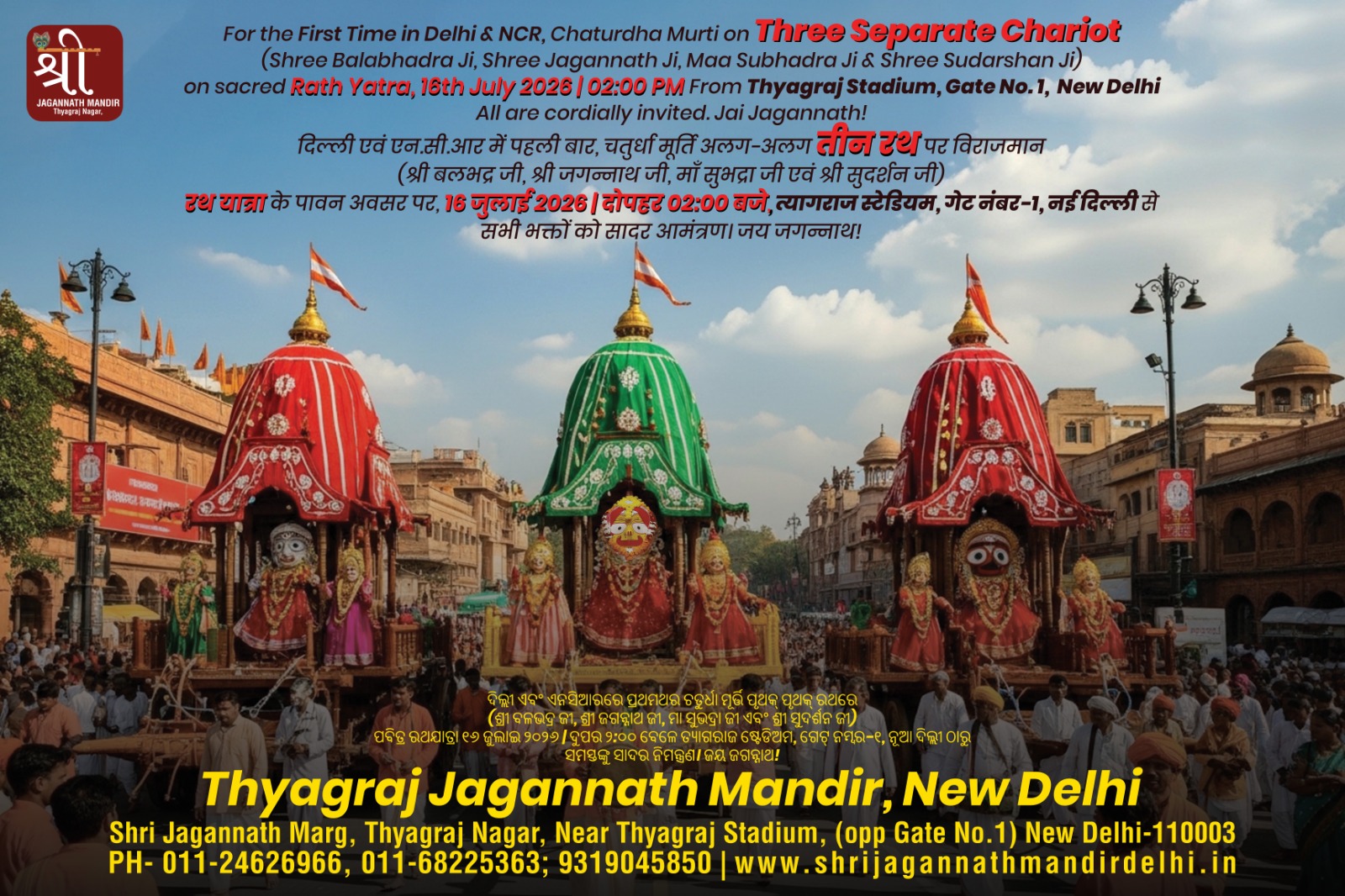

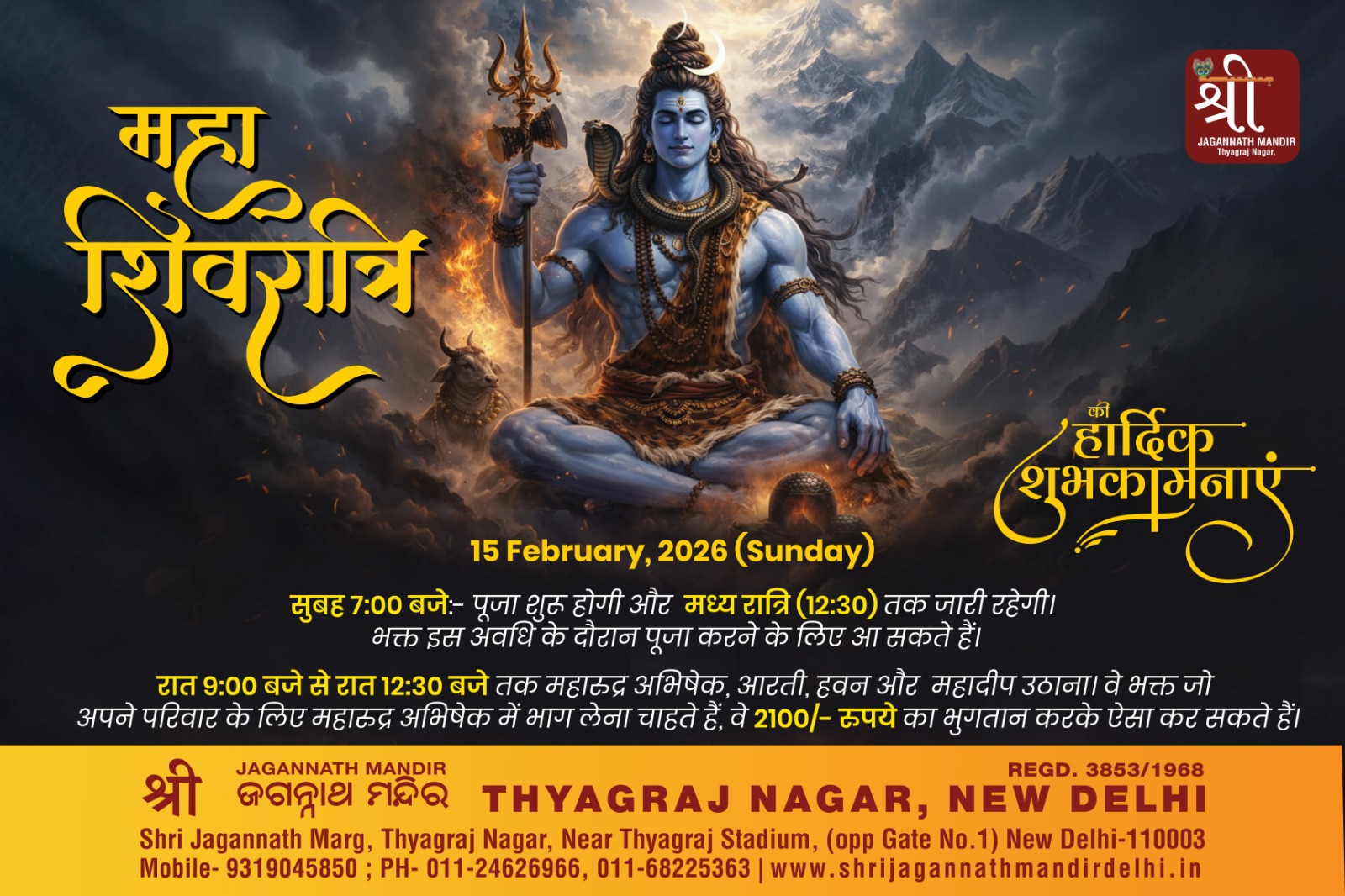

Supports Temple Activities: Donations help fund festivals, daily worship, and religious programs.

-

Facility Maintenance: Ensures upkeep of temple infrastructure and visitor facilities.

-

Educational Outreach: Helps in running spiritual classes, workshops, and youth engagement programs.

-

Charity and Welfare: Funds community service like health camps, Narayan Seva, and disaster relief.

💰 Tax Benefits Under Section 80G

-

Claim Deductions: Donations to Shri Jagannath Mandir are eligible for up to 50% deduction under Section 80G.

-

80G Certificate: Upon donation, you receive an official receipt and certificate to claim during tax filing.

-

Legal Transparency: Shri Jagannath Mandir is a compliant and certified organization, ensuring your donation is well-utilized.

📢 To claim deductions, always request an official receipt and 80G certificate after your donation.

💡 FAQs on Donating to Shri Jagannath Mandir

Q1. Is Shri Jagannath Mandir eligible under 80G?

Yes. Shri Jagannath Mandir, Thyagraj Nagar, Delhi is registered and eligible to issue 80G certificates.

Q2. How much tax can I save?

You can claim a deduction of up to 50% of the donation amount, subject to applicable limits.

Q3. What modes of donation are accepted?

Cash, cheque, online transfers, and UPI are usually accepted. Contact the temple office for current options.

Q4. Do I get a receipt and certificate immediately?

Yes, upon donation, a receipt and 80G certificate are issued, which can be used during your tax filing.

Q5. Can corporates donate to the Mandir?

Yes. Corporates and institutions can also contribute and claim deductions under their CSR and tax filings.

📍 हमारा मंदिर

श्री जगन्नाथ मंदिर, त्यागराज नगर, दिल्ली – 110023

Google Map लिंक: Shri Jagannath Mandir Location

📞 संपर्क करें

फोन: +91-9319045850

ईमेल: info@shrijagannathmandirdelhi.i

DONATION :

Paying to